2nd Quarter 2016 Business Conditions Survey Results Show Neutral Outlook

(South Burlington, Vt.) Today, Lisa Ventriss, President of Vermont Business Roundtable (VBR) and Jeffrey Carr, President, Economic & Policy Resources (EPR), announced the Q2 2016 results of their joint initiative, the VBR-EPR Business Conditions Survey.

The survey, which is conducted quarterly, provides both a look back at the previous quarter and a predictive index going forward. The data for both the backward and forward-looking questions are weighted to the Vermont economy by sector employment and turned into “diffusion indices”.[1] These diffusion indices provide a tool for analyzing and presenting insight into the Vermont economy over time through the sentiments of the Roundtable members.

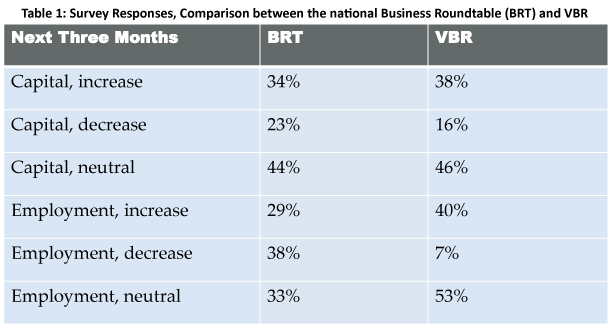

The raw survey data can be easily compared to the national Business Roundtable CEO Survey, a quarterly survey of national and multi-national companies, which contains similar questions to the VBR/EPR Survey in terms of employment and capital spending. Comparing these two surveys revealed that Vermont companies are more positive-to-neutral about employment stability than national companies, while capital spending outlooks were slightly less optimistic than in the past for VBR respondents and more closely align with BRT results.

1 Each question on the survey is weighted by sector employment and the diffusion number is formulated by giving each “strong positive” answer a numerical value of 1.0, “mild positive” answers a numerical value of 0.5, neutral answers a value of 0, “mild negative” answers a value of -0.5, and strong negative values of -1.0. The diffusion index numbers are then formulated based on these numerical values. A value of 100 would mean that every respondent answered “strong positive”, a value of 0 would mean that every respondent answered neutrally, and a value of -100 would mean that every respondent answered “strong negatively.”

Overall Findings

The latest survey, which was conducted during the first two weeks of April 2016, achieved a response rate of 74 percent overall and included a 50 percent or greater response rate from all but three sectors within the membership. The survey asked eight retrospective and prospective questions about the CEOs’ economic outlook, demand, capital spending, and employment. Survey results show that:

- Most responses to the question about the state’s overall business climate outlook were neutral (51%). The remaining responses were split between optimistic (28%) and pessimistic (20%).

- More than 60 percent of respondents (62%) shared negative outlooks specifically with ease of hiring for available positions; and,

- The education sector had the most optimistic outlook on the general business climate, while the health care sector had the least optimistic outlook.

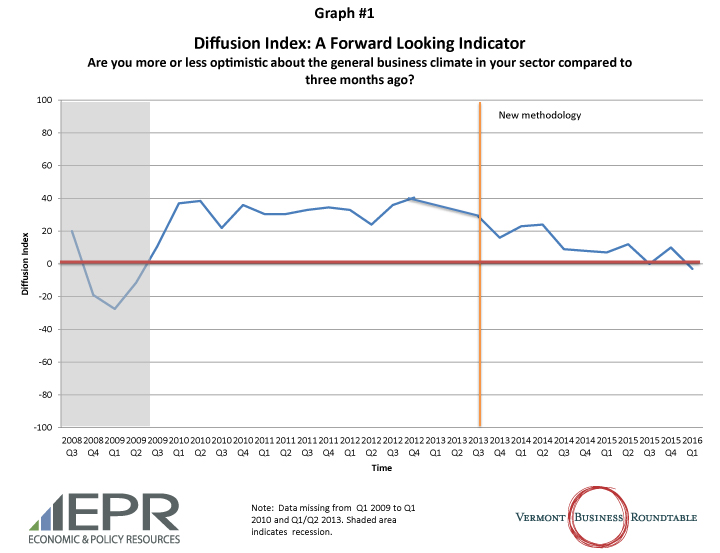

Graph #1 below shows the diffusion index of overall economic outlook, which measures the level of confidence (optimism or pessimism) respondents have about different aspects of the economy based on the first question on the survey, and can range from 100 (where 100% of respondents answered “strong positive”) to -100 (where 100% of respondents answered “strong negative”).

For this reporting period, the diffusion index shows a decline in optimism from Q1 2016 to Q2 2016, indicating that Vermont CEOs continue to feel neutral to mildly pessimistic about the business climate for the coming three months.

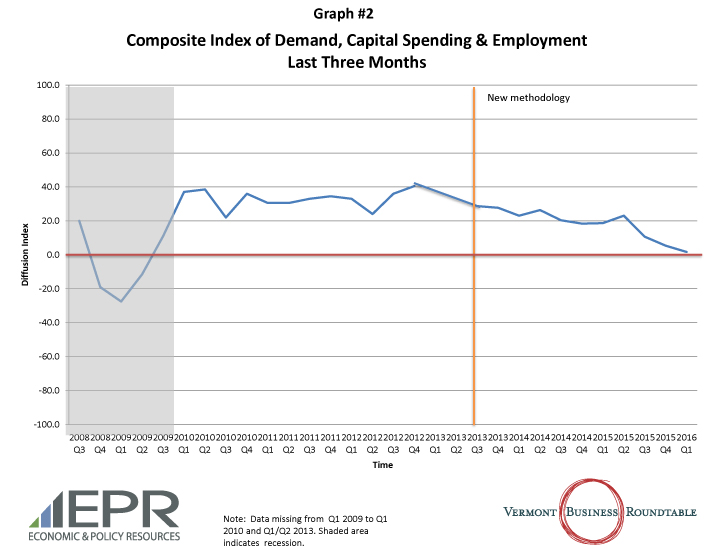

Graph #2 above shows the composite index of the diffusion index points for the questions relating to demand, capital spending, and employment in the next three months. The majority of responses were neutral and the index point slid from a mildly optimistic index point of 19 last survey to an index point of 9 this survey, indicating a shift toward true neutral. The outlook remains in the neutral range.

Also included in the survey was the opportunity for Roundtable members to express their opinions on other topics adversely affecting their businesses. The greatest frequency of responses from members concerned high taxes and tax policies, health care costs, economic growth/development in Vermont, and the difficulty of finding workers.

The next survey will be conducted in early July 2016.

The Vermont Business Roundtable (VBR) is a nonprofit, nonpartisan organization of chief executive officers of Vermont’s leading private and nonprofit employers, representing geographic diversity and all major sectors of the Vermont economy. The Roundtable is committed to sustaining a sound economy and preserving Vermont’s unique quality of life by studying and making recommendations on statewide public policy issues. www.vtroundtable.org.

Economic & Policy Resources, Inc. (EPR) has been providing private and public sector clients throughout the U.S. and Canada with problem-solving economic research and analysis services for more than 25 years. Our professionals bring a broad spectrum and a deep reservoir of problem-solving knowledge and experience in applied economics to each assignment. We put our capabilities and experience to work for our clients so that they have the insight and understanding necessary to move forward with confidence. EPR has successfully completed assignments throughout the United States and in eastern Canada. www.epreconomics.com.